40+ Mortgage calculator 40 year amortization

Download our FREE Reverse Mortgage Amortization Calculator and edit future. Where the most common.

Pin On Favorite Places Spaces

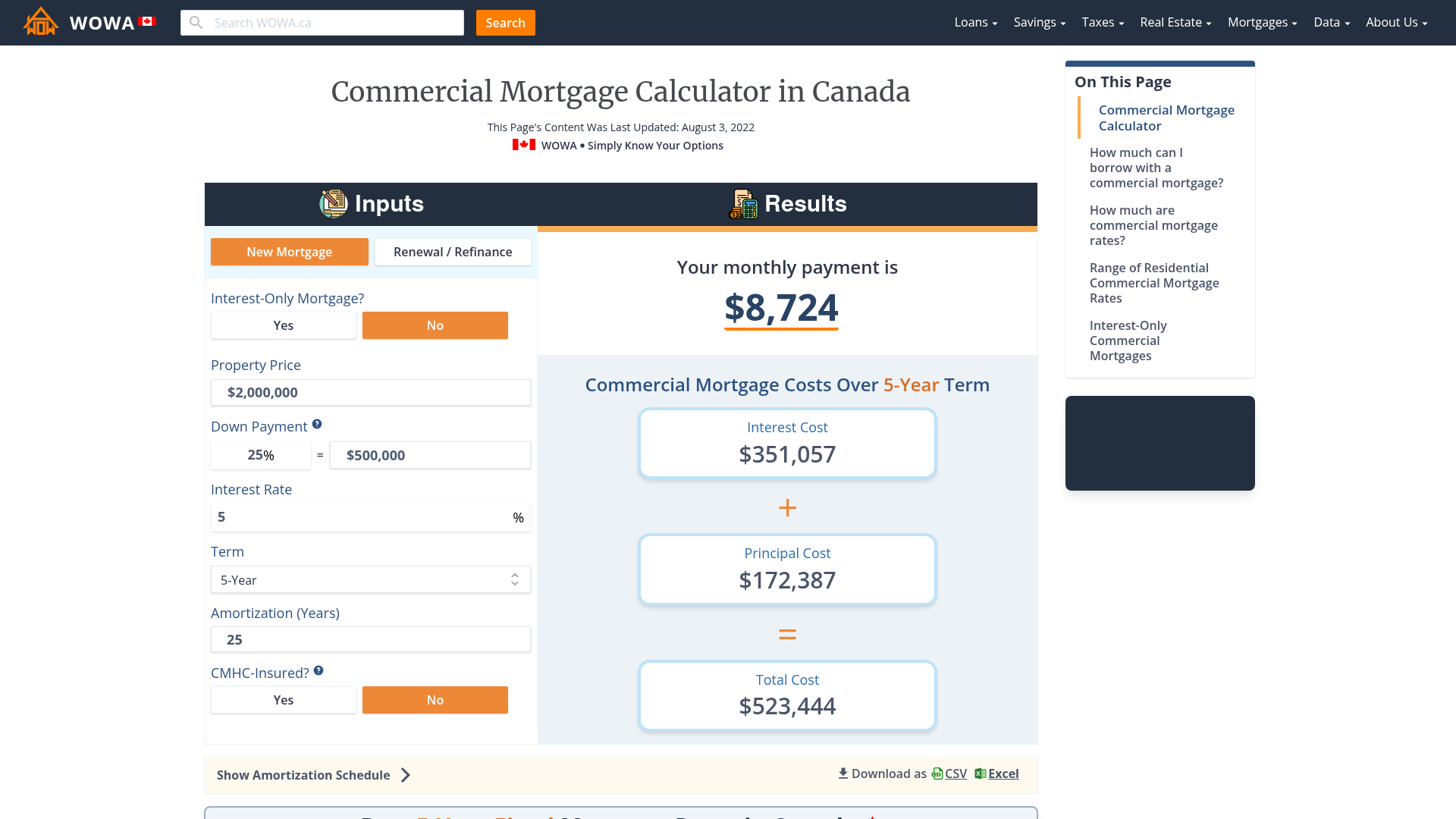

Basically you pay the first 10 years of principal and interest payments based on the full amortization table.

. For example a 30-year. All Reverse Mortgage Inc. Brets mortgageloan amortization schedule.

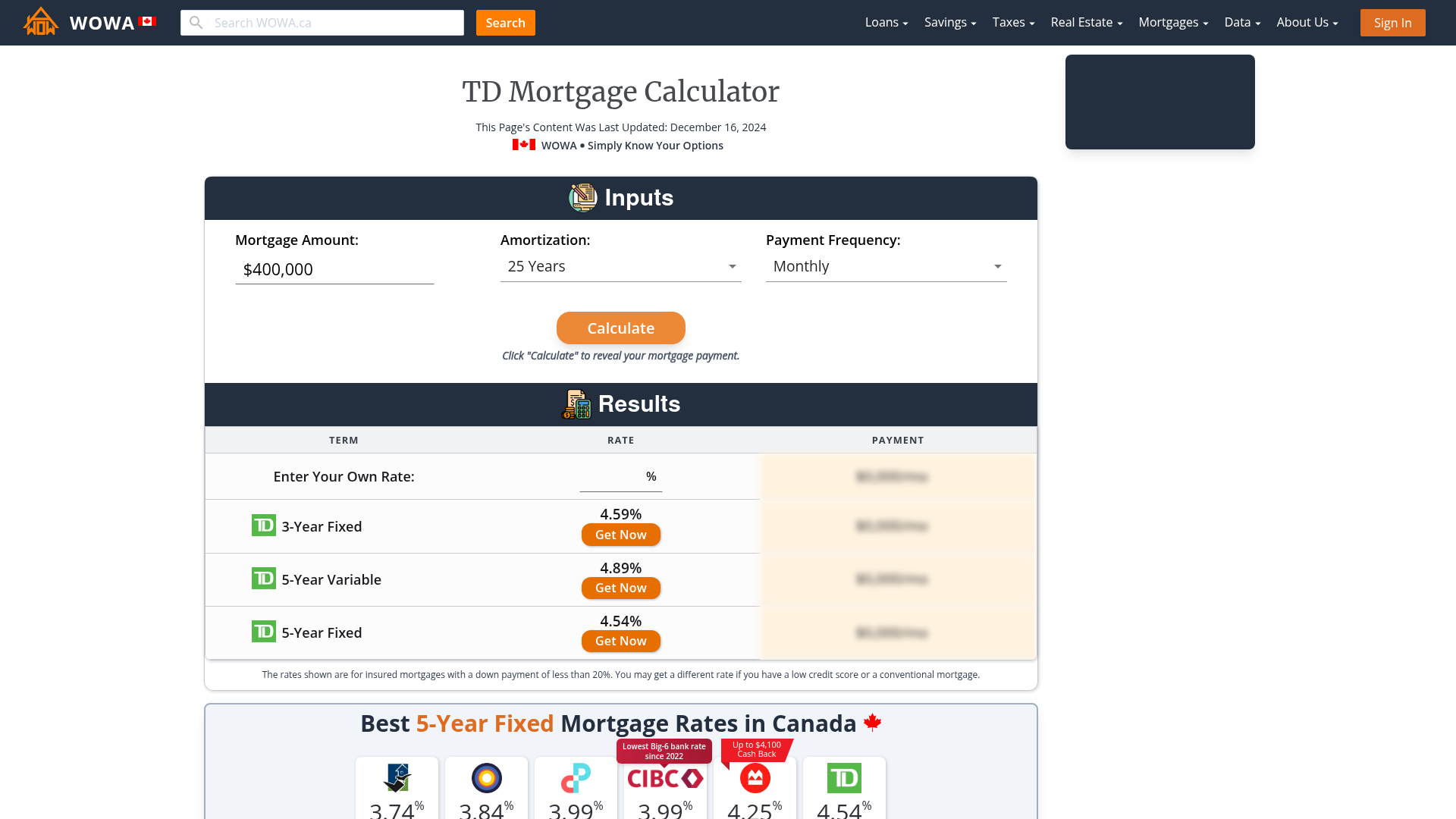

The TD Mortgage Payment Calculator uses some key variables to help estimate your mortgage payments. What you should know about your mortgage payments. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules.

For example a 30-year FRM has 360 monthly payments spread across 30 years. Biweekly Amortization Schedule. Types Of Mortgage Loans.

Law the value of these assets can be deducted month-to-month or year-to-year. Original or expected balance for your mortgage. Just like with any other amortization payment schedules can be forecasted by a calculated amortization schedule.

This early loan payoff calculator is useful to calculate how many years in the future that you want to pay off the loan. Auto Loan Payment Schedules. You can also pay off your mortgage early by increasing your monthly payment you can use the Mortgage Payoff CalculatorUse the mortgage calculator with PMI and extra payments to calculate your monthly or biweekly mortgage.

Yes but only yearly amortization tableThe interest and principal paid during the year the remaining balance at years end and the total. And a 15-year and 30-year. Payment Date Payment Interest Principal Tax Insurance PMI.

Determine monthly payments for 5- to 50-year fixed rate mortgage loans. By the end of the mortgage term in the year 2033 by contrast the interest payment would be only 189 and the principal would be a whopping 41187. Annual Interest Rate.

This is a record that shows the exact number of payments you need to make by the due date. 35 or even 40 years. Almost any data field on this form may be calculated.

Taxpayers can deduct the interest paid on first and second mortgages up to 1000000 in mortgage debt the limit is 500000 if married and filing separately. In the US the most common mortgage loan is the conventional 30-year fixed-interest loan which represents 70 to 90 of all mortgages. Once the term ends you make the balloon payment.

If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1 3 5 or 7 years. By making additional monthly payments you will be able to repay your loan much more quickly. This printable amortization schedule will help you to get a month by month calendar of exactly how much of your monthly income will be devoted to paying off your mortgage.

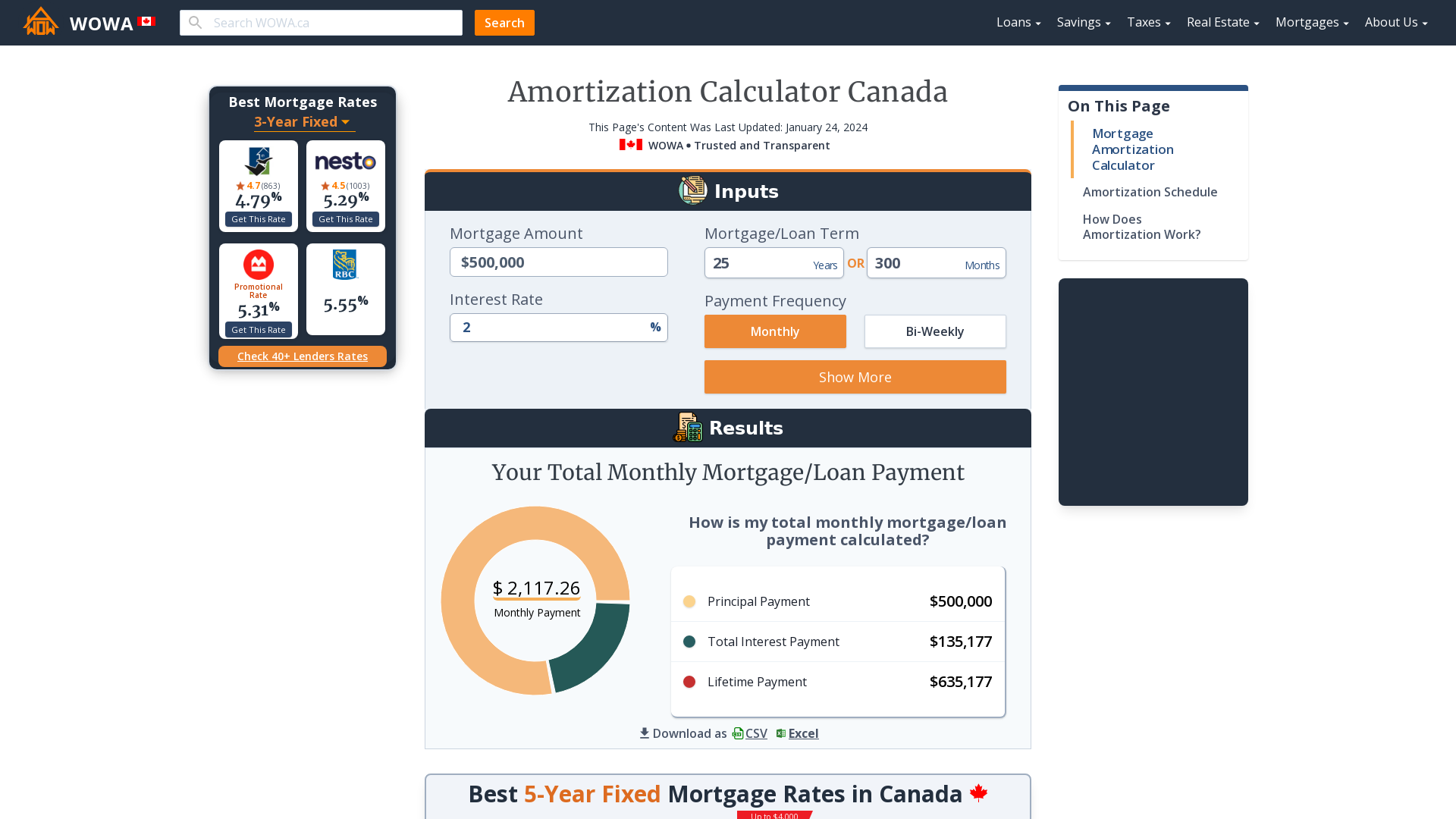

These are also the basic components of a mortgage. The most common mortgage in Canada is the five-year fixed-rate closed mortgage as opposed to the US. The calculator lets you determine monthly mortgage payments find out how your monthly yearly or one-time pre-payments influence the loan term and the interest paid over the life of the loan and see complete amortization schedules.

Microsoft Excel Mortgage Calculator with Amortization Schedule. How to estimate mortgage payments. If you would like to pay twice monthly enter 24 or if you would like to pay biweekly enter 26.

We also offer more specific mortgage amortization auto amortization calculators. This is typically generated by an amortization calculator using the. Some mortgage lenders offer 35-year and even 40-year amortization periods.

Amortization as a way of spreading business costs in accounting generally refers to intangible assets like a patent or copyright. The following table shows the rates for ARM loans which reset after the tenth year. 1 year 2 year 3 year 4 year 5 year 10 year 15 year 20 year 25 year 30 year 40 year.

If you are considering a major purchase requiring a loan amortization calculator furnishes a tool for predicting what payments will be. FRM payments are based on a traditional amortization schedule. With a 15-year fixed loan the locked interest rate keeps payments in a traditional amortizing schedule.

Mortgages are how most people are able to own homes in the US. For example a 30-year FRM comes with 360 payments spread throughout 30 years. Under Section 197 of US.

Current 10-Year Hybrid ARM Rates. The payment is based on a traditional amortization schedule such as a 30-year loan. Browse and print common amortization schedules.

This equates to 27 percent of the 7 percent rate on the loan. Account for interest rates and break down payments in an easy to use amortization schedule. A mortgage usually includes the following key components.

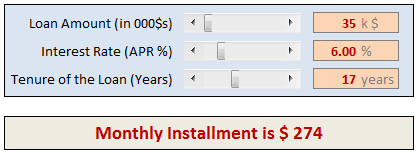

Enter the appropriate numbers in each slot leaving blank or zero the value that you wish to determine and then click Calculate to update the page. However note that 30-year FRM rates are generally higher by 025 to 1 than 15-year FRMs. To get the most out of the mortgage amortization calculator you can personalize it with your own numbers.

On a traditional loan you typically have a structured 30-year repayment and the amortization schedule will show a balance that decreases with each payment. Fixed-rate mortgages adhere to a traditional amortization schedule which tells you the precise number of payments you need to make within the term. Our calculator includes amoritization tables bi-weekly savings.

Use our free mortgage calculator to estimate your monthly mortgage payments. It also breaks down how much of each payment goes toward your principal loan amount and your interest charges. Early Loan Payoff Calculator.

With the tax deduction the effective mortgage rate is 511 percent. You will require mortgage insurance if you make a mortgage down payment of less than 20. To get an amortization schedule for your 15-year fixed-rate mortgage use the calculator on top of this page.

This is the purchase price minus your down payment. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. The German Bausparkassen have reported nominal interest rates of approximately 6 per cent per annum in the last 40 years as of 2004.

Payments per year - defaults to 12 to calculate the monthly loan payment which amortizes over the specified period of years. List of 5 items. Browse and print common auto loan payment schedules.

While there is no set limit on the maximum mortgage amortization period for uninsured mortgages the maximum for insured mortgages is 25 years. And moderator of ARLO has 40 years of experience in the mortgage banking. On a 30-year loan with a 7 percent interest rate the government pitches in 189 percent of the cost of interest through the tax deduction.

View complete amortization tables. Check out the webs best free mortgage calculator to save money on your home loan today.

Mortgage Payment Calculator Mortgage Calculator Using Microsoft Excel

This Tool Will Allow You To Plan Assessments For Each Math Unit Based On Strand And Specific Expect Math Curriculum 2nd Grade Math Teachers Pay Teachers Seller

Ashampoo Burning Studio 2017 V9 Keygen H33twood248 Spreadsheet Template Excel Templates Spreadsheet Business

Mortgage Apr Vs Interest Rate Infographics Here We Provide You With The Top 5 Differences Between Mortg Mortgage Marketing Refinancing Mortgage Mortgage Payoff

Borrow Loan Company Responsive Wordpress Theme Loan Company Amortization Schedule The Borrowers

Journal Entry Template Double Entry Journal Journal Entries Journal Template

Td Bank Mortgage Payment Calculator Sep 2022 Wowa Ca

Ssjtafrpq7xz M

Excel Stock Count Spreadsheet List Template Templates Free Web Template

Section 1 Form Scientific Notation Word Problems Word Problems Power Of Attorney Form

Pin On Comment Card Rockstars

How To Use A Mortgage Calculator Comparewise

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

Quality Internal Business Proposal Template Action Plan Template Editable Lesson Plan Template Lesson Plan Template Free

Quality Internal Business Proposal Template Action Plan Template Editable Lesson Plan Template Lesson Plan Template Free

Bfiltqjc Ibeqm

Mortgage Amortization Calculator Canada Wowa Ca